SMS fraud is a growing problem in today's digital society, putting both individuals and businesses at risk. Fraudsters exploit the SMS channel to trick recipients, hijack sender identities, or trigger expensive, fake traffic – with serious consequences. As a provider of messaging solutions for businesses, we see it as our responsibility not only to deliver technology but also to strengthen our customers’ awareness of fraud. In this article, we outline recommended actions you can take to prevent, detect, and respond to SMS fraud – and what to do if your business is affected.

Understanding SMS fraud

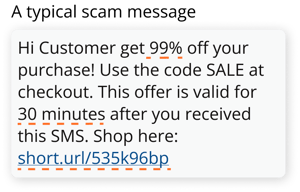

Knowing how SMS fraud works is key to protecting your business and customers. Fraudsters use SMS to trick recipients into revealing sensitive information or becoming victims of financial scams. Staying informed, being proactive, and recognising warning signs – such as unexpected messages or unusual content – are essential steps in prevention.

Who are the scammers?

Fraudsters can be lone individuals or part of organised criminal networks - sometimes even insiders. They may impersonate banks, authorities or well-known companies. Common examples of SMS fraud attempts include:

-

"We've detected fraud on your account – click here"

-

"You have a delivery pending – collect it here"

-

"Your system is infected – click to install antivirus"

How to identify SMS fraud - warning signs to look out for

Scam SMS messages often closely resemble legitimate business communication, making them hard to detect. As a company, it’s important to educate both staff and customers on how your genuine SMS messages look. Legitimate marketing campaigns usually require recipient consent (opt-in) – fraudsters don’t care about such rules, which is a major red flag. Other warning signs include:

-

Unusual wording or grammatical errors

-

Strange requests (e.g., verifying an account via a link)

-

Sender IDs that look similar to, but don’t exactly match, your brand

-

Unsolicited campaigns without customer consent

Smishing

Smishing is a blend of SMS and phishing. The recipient is tricked into clicking on malicious links that lead to fake websites. Protect your customers by educating them and clearly communicating what your SMS messages look like – and what you will never send via SMS (e.g., login links).

SMS spoofing

Spoofing is when a fraudster fakes the sender ID to make the message appear as though it's from a legitimate company. Inform your customers about the exact sender ID you use, and protect it using LEKAB’s Sender ID Protection. For example, the sender ID “LEKAB” may be protected, but “LEKAB AB” might not be – a vulnerability that fraudsters can exploit.

Artificially Inflated Traffic (AIT)

AIT is a fraudulent tactic where systems – often via unprotected forms or APIs – are exploited to trigger large volumes of SMS messages to mobile numbers without the recipients' consent or awareness. This can result in high costs for your company without any real recipients receiving the messages. Protect your business by:

-

Implementing CAPTCHA in message workflows

-

Securing open APIs with access keys

-

Restricting internal system access with permissions and 2FA

-

Blocking destination numbers your business doesn’t typically message

Actions to take when affected by SMS fraud

At LEKAB, your security is our top priority. We use monitoring and fraud prevention systems to protect our clients – but we also know fraudsters are constantly evolving. Unfortunately, no system can prevent every attempt. That’s why it’s crucial for your business to have internal safeguards in place.

If you suspect your company has been affected by SMS fraud, we recommend the following:

1. Contact us immediately if you believe your system has been hacked. We will deactivate your account and block the relevant traffic routes.

2. Report the incident to the Police.

3. Forward suspicious SMS messages to Telekområdgivarna's 7726. These digits correspond to “SPAM” on your phone keypad and are part of a global reporting service. This helps operators gather data and block fraudulent numbers to protect others.

How to avoid falling for Scam SMS ("bluff-SMS")

- Check the Sender ID or number. Exercise caution if the sender's number or alphanumeric Sender ID looks unfamiliar.

- Don't click links from unknown sources. Fraudsters often try to trick you by surprising or alarming messages.

- Don’t call phone numbers provided in suspicious messages – instead, look up the number yourself and call the company directly.

- Be cautious of unexpected messages, especially those asking you to stop an ongoing fraud on your bank account. Banks will never ask you to log in or provide personal information via SMS.

- Check for misspellings and grammar errors.

- Never provide personal information such as; card number, ID number, log-in credentials via SMS.

Read more tips & tricks at Svårlurad on how to avoid SMS phishing scams.

We take our customers’ security seriously

As a member of the industry association MORGAN, we actively work to combating fraud and enhancing the security of A2P messaging. LEKAB's solutions secure the entire communication chain – from Sender ID Protection to technical access. With role-based access to our platform and geographic restrictions, we minimise the risk of unauthorised access, incorrect traffic, and international fraud attempts.

If you want to learn more about how LEKAB combat fraud and how you can protect your business, contact us today. We'll be happy to discuss how our solutions can help you stay secure and ensure your business messaging remains a trusted and effective communication channel.